Can salaried person apply for GST?

Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services in India. It has replaced various indirect taxes like VAT, excise duty, and service tax, simplifying the taxation system. GST registration is mandatory for businesses and individuals involved in the supply of goods or services above a certain threshold turnover. But what about salaried individuals who are not engaged in any business activity? Can they apply for GST registration in Bangalore? In this blog, we will explore the possibilities and circumstances under which salaried individuals may consider applying for GST registration.

Understanding GST Registration

GST registration is a legal requirement for certain individuals and businesses in India. It is mandatory when:

Threshold Turnover:

When the aggregate turnover of a business or individual crosses the prescribed threshold limits. As of my knowledge cut-off date in September 2021, the threshold limits were as follows:

For Goods: Rs. 20 lakhs (Rs. 10 lakhs for Special Category States).

For Services: Rs. 20 lakhs (Rs. 10 lakhs for Special Category States).

Interstate Supply:

When an individual or business makes interstate supplies, GST registration in Bangalore is mandatory regardless of turnover.

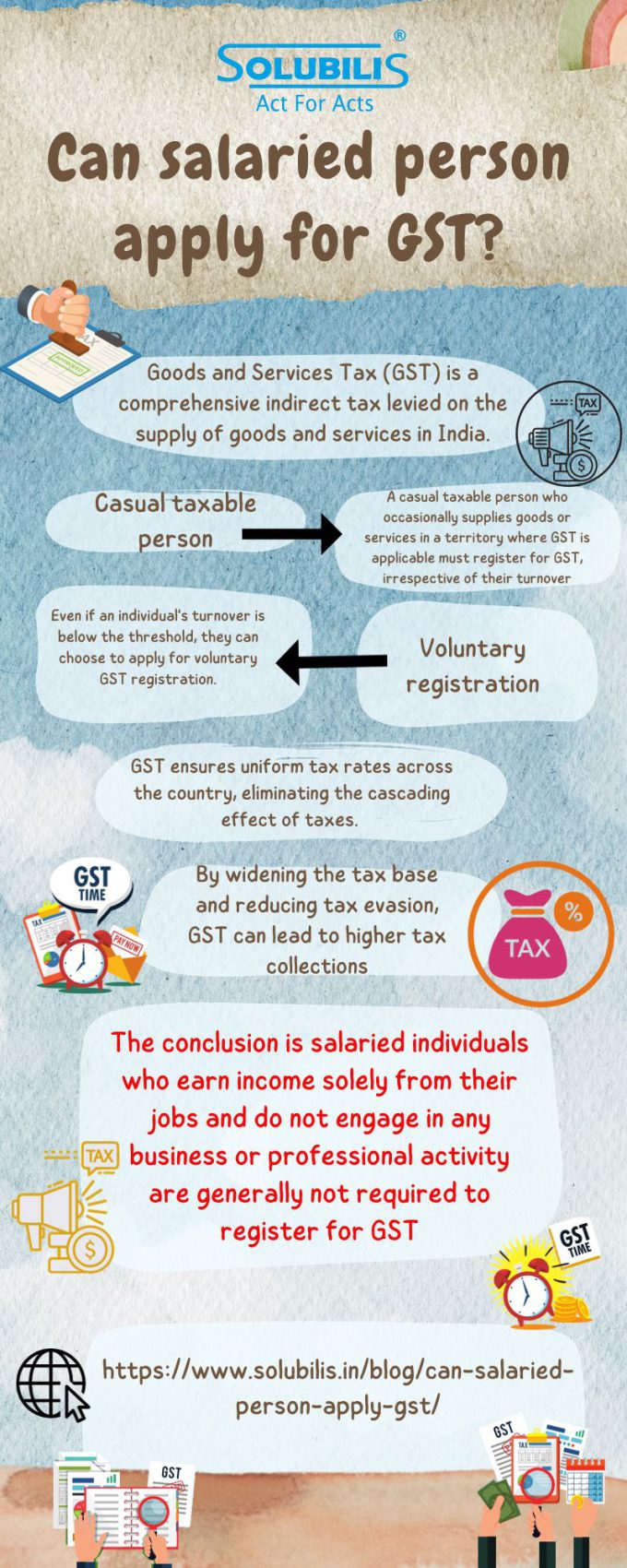

Casual Taxable Person:

A casual taxable person who occasionally supplies goods or services in a territory where GST is applicable must register for GST, irrespective of their turnover.

Voluntary Registration:

Even if an individual’s turnover is below the threshold, they can choose to apply for voluntary GST registration.

Salaried Individuals and GST Registration

Now, let’s discuss the applicability of GST registration to salaried individuals:

Solely Earning Salary Income:

Salaried individuals who solely earn income from their job and do not engage in any business or professional activity are generally not required to register for GST. This is because GST is primarily designed to tax the supply of goods and services during business activities.

Freelancers and Independent Professionals:

However, if a salaried individual is engaged in freelancing, consultancy, or any other independent professional activity and the total turnover from such services exceeds the prescribed threshold, they must register for GST. This applies even if their primary source of income is a salary.

Rental Income:

Salaried individuals who own properties and earn rental income are not required to register for GST unless their rental income exceeds the threshold limit. Rental income from residential properties is exempt from GST that has GST registration in Bangalore, but commercial properties are subject to GST if the threshold is crossed.

Investments and Capital Gains:

Income from investments such as stocks, mutual funds, or capital gains from the sale of assets is not considered supply under GST. Therefore, salaried individuals earning income through investments are not required to register for GST based on this income.

Voluntary Registration:

Even if a salaried individual’s turnover does not exceed the threshold, they have the option to apply for voluntary GST registration. This can be beneficial in some cases, such as when they want to claim input tax credit (ITC) on GST paid for personal expenses or when they foresee their turnover crossing the threshold in the near future.

Benefits of GST Registration for Salaried Individuals

While GST registration may not be mandatory for most salaried individuals, there are certain advantages to voluntarily registering for GST:

Input Tax Credit (ITC):

Registered individuals can claim ITC on the GST paid on goods and services used for business or professional activities. This can result in cost savings and reduced tax liability.

Compliance:

GST registration in Bangalore ensures compliance with tax laws. It allows individuals to issue tax-compliant invoices and collect GST from customers when applicable.

Business Expansion:

If a salaried individual plans to start a side business or expand into a business activity in the future, having GST registration in place can streamline the process.

Participation in E-commerce:

If an individual wants to sell goods or services on e-commerce platforms, many platforms require GST registration as a prerequisite.

Recent news on GST evasion

The tax authorities are set to spread their net more extensive against online gaming companies. As per sources, the Directorate General of GST Intelligence is set to launch investigations against 100 more firms in the coming months to discover if there has been any avoidance of goods and service tax.

Moreover, various state GST divisions, for example, those in Haryana and Maharashtra are likewise investigating exercises of a portion of the online gaming companies. Comparative examinations are likewise being sent off by Central GST experts in certain examples.

Meanwhile, following the GST Council decision, a 28 percent GST will be collected on the full face value of wagers put at the passage level and not on the rewards that is utilized to put down additional wagers.

Significance of GST

Simplified Tax Structure:

GST with GST registration in Bangalore replaces a complex web of indirect taxes like excise, VAT, service tax, and others with a single tax, making it easier for businesses to understand and comply with tax regulations.

Uniform Taxation:

GST ensures uniform tax rates across the country, eliminating the cascading effect of taxes. This promotes fair competition and reduces tax evasion.

Increased Tax Revenue:

By widening the tax base and reducing tax evasion, GST can lead to higher tax collections, which can be used for infrastructure development and other public services.

Reduced Compliance Burden:

Under GST, businesses file a single consolidated return, reducing the compliance burden and paperwork. This simplifies the tax filing process.

Boost to Economic Growth:

GST with GST registration in Bangalore can lead to an increase in economic activity as it encourages businesses to become more tax-compliant. It also reduces production costs, which can lead to lower prices for consumers.

Conclusion

In summary, salaried individuals who earn income solely from their jobs and do not engage in any business or professional activity are generally not required to register for GST. However, there are exceptions, such as when they have independent professional income exceeding the threshold or when they choose to register voluntarily.

It’s essential for salaried individuals to understand the GST regulations and consult with a tax professional to determine their specific obligations and benefits regarding GST registration. Ultimately, GST registration in Bangalore for salaried individuals depends on their income sources and future business plans.