Solubilis offers comprehensive company registration services across India in cities like Chennai, Bangalore, Hyderabad, and Cochin. We specialize in registering various types of companies, including Private Limited, Public Limited, One Person Company, Limited Liability Partnership (LLP), and more. Our services extend to associated registrations such as Trademark, GST, and Company Secretarial services. Trust Solubilis for seamless registration and expert consultancy services.

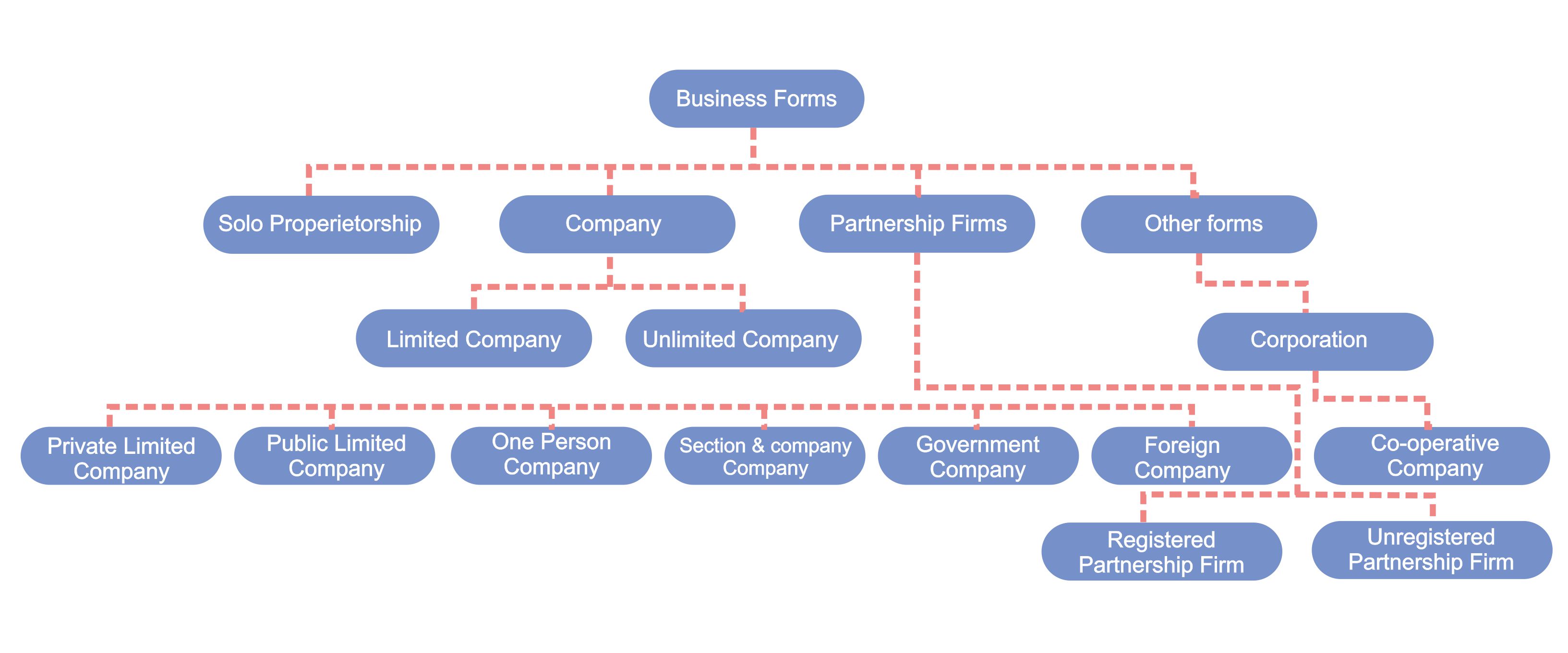

Sole proprietorship, a prevalent business structure in India since ancient times, is solely owned and operated by an individual. It's a taxable entity where the owner's and business's incomes merge as one. All profits and debts are the owner's personal liabilities. This arrangement means that the business and the owner are considered a unified entity, impacting both business and personal income.

Partnership firm registration in Chennai involves shared ownership and joint management responsibilities among two or more individuals. Profits and losses are distributed based on their capital and terms in the partnership deed. Partners, collectively forming the firm, have a limit of twenty members in a typical partnership setup. Understanding the different types of partnership firms in India is crucial in this business structure.

This business form, an age-old practice, involves a partnership crafted through a formal partnership deed among two or more individuals. Registration with the registrar of firms is essential, adhering to the regulations of the Indian Partnership Act 1932. Partners commit to conducting business for profit, bearing unlimited liability risks as outlined in their agreement

This partnership involves two or more people who've agreed, via a partnership deed, to conduct a business for financial gain. While similar to a registered partnership, this entity isn't officially registered. Tax treatment and some legal aspects differ for this unregistered setup compared to registered partnerships.

Traditional partnerships might not suit large groups seeking flexibility with limited liability. In a typical partnership, partners have full and joint liability. Limited Liability Partnership (LLP) is a newer legal entity offering partnership flexibility with limited liability, governed by the Limited Liability Partnership Act 2008. In an LLP, each partner's liability is limited to their investment, as detailed in the LLP's Memorandum of Association (MOA).

A company, registered under the Indian Companies Act, 2013, is an association of individuals conducting business as specified in their Memorandum of Association. Considered a legal entity, a company has the rights of an individual, owning property and operating independently.

It can be limited, unlimited, or fall under various types such as

chosen based on business type and size.

A Government Company is established through collaboration between the government and the private or public sector. It refers to a company where at least 51% of the paid-up share capital is held by either the Central or State government, or a combination of both.

Public limited company is a company which is not a private limited company and subscribed by minimum 7 members. From investors point of view Public limited company is the most attractive form of business. The promoters shall have the option of inviting investments from the public. Since, public money is involved, the operation of the company is regulated by the Companies Act, SEBI and other regulations. The promoters should maintain complete transparency in sharing most of the company related information to the public.

Access to Capital: Public limited companies can raise funds easily by selling shares to the public through stock exchanges. This allows them to gather large amounts of capital to support expansion, research, and other business initiatives.

Limited Liability: Shareholders of a public limited company have limited liability, meaning their personal assets are protected in case the company faces financial difficulties or legal issues. This protects shareholders from being held personally responsible for the company's debts beyond their investment in the company's shares.

A One Person Company (OPC) is a fresh addition under the Companies Act, 2013. Previously, individuals could operate only as sole proprietors, exposing them to unlimited liability and constraints. OPC provides a solution by offering limited liability protection to the business owner. However, OPCs are suitable mainly for small enterprises due to their structure.

The Private Limited Company is widely favored in India. It necessitates a minimum of 2 members to start. Shares in this company type are closely held and not publicly tradable. Private limited companies face fewer regulations compared to their public counterparts. Many successful family-owned businesses in India operate as private limited companies.

A Corporation is an entity formed by a Central or State Act, like the Life Insurance Corporation of India established under the Life Insurance Corporation Act, 1956. These entities are governed by the rules outlined in their respective acts.

Section 8 Companies, under the Companies Act, aren't solely profit-oriented; they also serve as charitable entities with limited liability. These associations aim to promote various fields like commerce, art, science, education, and more. Profits earned must be used solely for furthering these objectives. Section 8 associations can function as either limited or private limited organizations.

A Foreign Company refers to a corporate entity formed outside India but operating a business within the country. These entities engage in business activities in India, primarily governed by Indian laws.

A Co-operative Society is a group of people joined by mutual agreement to work together for a shared goal. They're registered under the Societies Registration Act of 1860 or, for non-profit goals, under section 8 of the Companies Act 2013. Registering under the Societies Registration Act, 1860 is a straightforward and uncomplicated process.

Expert strategies are crucial for a seamless business operation, ensuring safety during challenging situations. Our team of experienced CS, CMA, and CA professionals is here to provide professional guidance and support for your needs.

Staying alert with instant notifications is a smart approach. We ensure our messages reach the right people at the right time through emails, texts, and WhatsApp

As experienced faculty, we understand the ins and outs of business. We provide clear guidance and support from start to finish, ensuring transparent and lawful assistance throughout the process.

Build brand before business in our service approach. Our dedicated efforts ensure your business reaches its pinnacle seamlessly.

Online Meeting

Instant Online Meeting