Solubilis provide All Types of company registration in Chennai, Bangalore, Hyderabad, Cochin and anywhere in India. Our prolific services are extending on all limited company registrations like, Private limited Company, Public Limited Company, One Person Company, Limited Liability Partnership(LLP) and so on. All your company registration and its associative registration works like Trademark registration, GST registration, and Company Secretarial services are avail here. Get your registration and consultancy services with Solubilis.

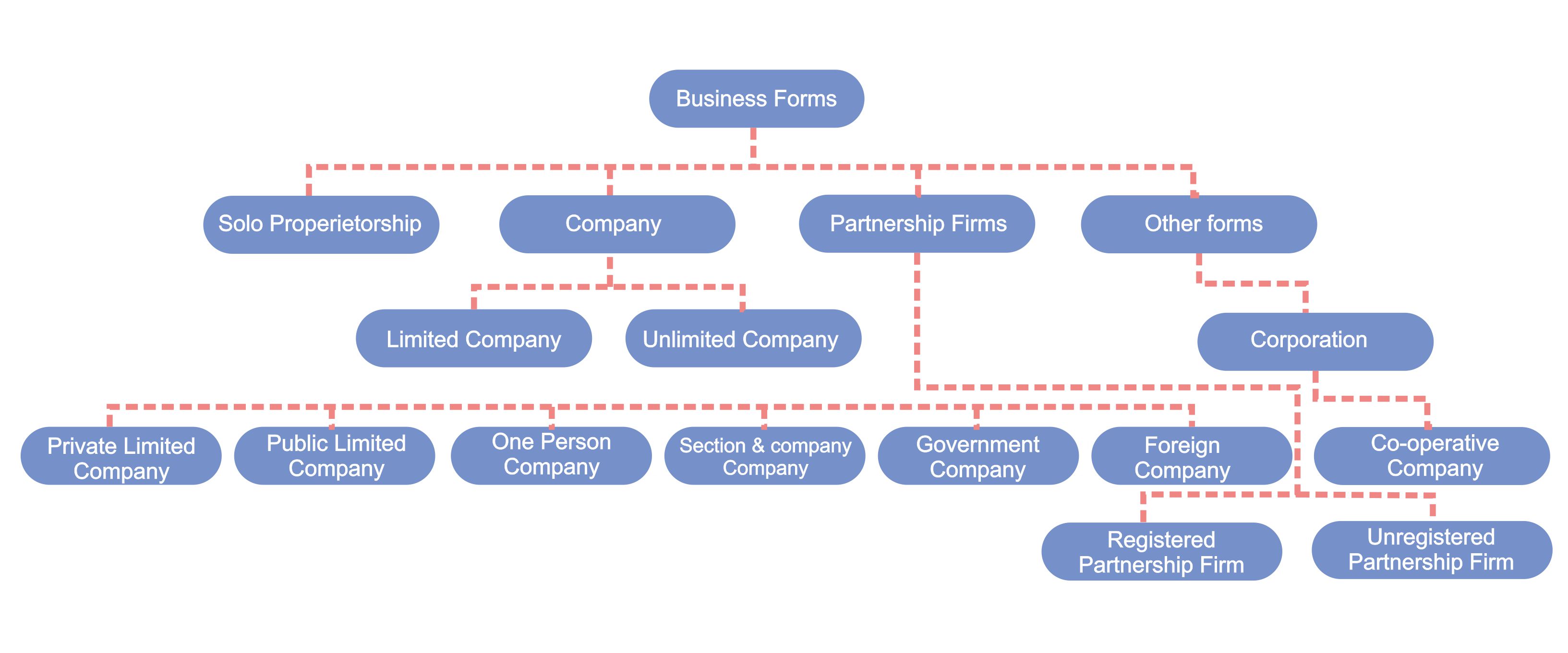

Sole proprietorship is the most common type of business entity found in India from ancient time. It is a type of enterprise run and owned by an individual. It is a Taxable entity, where in the owner and the entity are the same.Business income along with the personal income will also be assessed as owners’ income. Owner of the proprietorship is personally responsible for all the business transactions including its debts.

A partnership is a form of Company Registration in Chennai where two or more persons share ownership, as well as the responsibility of managing the business and share the income or losses, generated from the business, in the proportion of their capital in the firm and as agreed among them in the partnership deed.The persons who form a partnership are individually known as partners and collectively a firm or partnership firm. Normally in any partnership firm, the total number of partners should not exceed twenty. Let us briefly understand various types of partnerships in India.

This is also an ancient business form. It is a partnership formed by two or more persons by an instrument of partnership deed. The partners shall register their firm with the registrar of firms. The partners will comply the rules and regulations of Indian Partnership Act 1932. The partners are contractually bound to do the business for profit. The partners will carry the risk of unlimited liability.

It is a partnership formed by two or more persons who have agreed to do a business, by way of an instrument of partnership deed, for a financial benefit. This form of business is also created by way of a contractually binding agreement. It has all the similarities of a registered partnership, however this is not a registered entity. The tax treatment to these entities will differ besides certain legal impediments.

The traditional partnership is considered unsuitable for multidisciplinary combination comprising a large number of partners, seeking a flexible governance structure but with limited liability. Normal partnership involves full, jointly and several liability of the partners. Limited liability is a corporate structure comes with flexible advantage of partnership and limited liability. LLP is a legal entity introduced by the government in the recent years, liability of each partners is limited to the extent of the investment as stated in the MOA of the LLP. This form of partnership is governed by Limited Liability Partnership Act 2008.

A company is an association of persons registered under the Indian companies Act, 2013. The company form of business entities shall carry on the businesses, more specifically stated in their charter namely called Memorandum of Association of the company. It is a legal person in the eye of law. It can own property, conduct itself as an Individual. It can be a limited, unlimited, Section 8 companies etc. Companies can be formed in any of following form depending upon the business and its size:

Government Company is a creation of government and private/public partnership. Government company shall mean any company in which not less than 51% of the paid up share capital is held by the central or State government or Central and State governments.

Public limited company is a company which is not a private limited company and subscribed by minimum 7 members. From investors point of view Public limited company is the most attractive form of business. The promoters shall have the option of inviting investments from the public. Since, public money is involved, the operation of the company is regulated by the Companies Act, SEBI and other regulations. The promoters should maintain complete transparency in sharing most of the company related information to the public.

One person Company is a new form of entity introduced under the companies Act, 2013. Formally, individual can do the business as a sole proprietor only, but sole proprietorship form of business always carries the risk of unlimited liability on the proprietor, besides other limitations. OPC is an alternative arrangement to such business which will offer limited liability protection to the business owner. But OPC can be operated as an small enterprises only.

Private Limited Company is the most popular legal structure followed in India. Minimum 2 members are required to start a Private Limited Company. Shares of the Private limited are very closely held and the shares are not freely transferable and prohibited from trading publicly. Private limited companies are less regulated in comparison with the Public limited companies. Most of the successful family owned business houses in India are in the form of private limited companies.

A Corporation is an institution established or constituted by or under any Central or State Act. Example, Life Insurance Corporation of India established under Life Insurance Corporation Act 1956. These corporations are managed as per regulations stated in their act.

Companies registered under section 8 of the companies Act, not only less profit oriented business entities, but alsocharitable organizations with limited liability option. Section 8 Company is an association of person formed with the object of promoting commerce, Art, Science, Sports, Education, Research, Social welfare, Religion and so on. Sec 8 companies can apply their profits or income in promoting their objects only. This association can be a limited or a private limited organisation.

Foreign Company is a company or body corporate incorporated outside India, but has a place business in India. These entities will conduct business activities in India. Such business activities are predominantly regulated by Indian law.

Co-operative Society is an association of persons who were united together by mutual consent to deliberate, determine and act jointly for some common purpose and further registered under the Societies Registration Act of 1860. Society can also be registered under section 8 of the Companies Act 2013 for furthering their non-profit activities. However, registration of Society under the Societies registration act, 1860 Act shall be simple and Easy.

Professional tactics is most helpful one for running a smooth business and it safeguard while at complex situation. Practicing CS, CMA and CA people all are here for your professional assistance.

The smart way of work is never ignore instant notification. Our right message for right people will reach at right time. We follow you on E-mails, messages and Whats App.

As a proficient faculty we know all the ebb and flow in the business undertaking. We clearly implicit work progress and help until its final accomplishment and transparent guidance in proper lawful way.

Build brand before business is the golden threshold of our service implementation. All our hard work will reach your business in its peak without any complexities.

Online Meeting

Instant Online Meeting